Step-by-Step Guide to E-Verify Your Income Tax Return

Introduction:

E-verification of income tax returns is a crucial step in the filing process. It ensures that your tax return is authenticated and accepted by the income tax department. In this article, we will provide a comprehensive step-by-step guide to e-verify your income tax return. With the assistance of Web Online CA, you can easily complete the e-verification process and stay compliant with tax regulations.

Step 1: Choose the E-Verification Method

There are multiple methods available to e-verify your income tax return, including Aadhaar OTP, EVC (Electronic Verification Code) through net banking, and using a pre-validated bank account. Select the most convenient method for you.

Step 2: Login to the Income Tax e-Filing Portal

Visit the official income tax efiling and log in using your credentials. If you are a first-time user, register yourself and create an account.

Step 3: Access the E-Verification Options

After logging in, go to the "My Account" section and click on "E-Verify Return." You will find a list of available e-verification options.

Step 4: Choose the Desired E-Verification Method

Select the preferred e-verification method from the available options. Follow the instructions provided for each method to proceed with the verification.

Step 5: Generate and Enter OTP/EVC

Depending on the chosen method, you may need to generate an OTP or EVC. If using Aadhaar OTP, ensure that your Aadhaar is linked to your PAN. If using EVC, it will be sent to your registered mobile number or email address. Enter the OTP or EVC in the designated field.

Step 6: Complete the E-Verification Process

Once the OTP or EVC is entered, submit the verification request. The system will validate the details and authenticate your income tax return.

Step 7: Confirmation of E-Verification

After successful e-verification, you will receive a confirmation message. It is advisable to download and keep a copy of the confirmation for future reference.

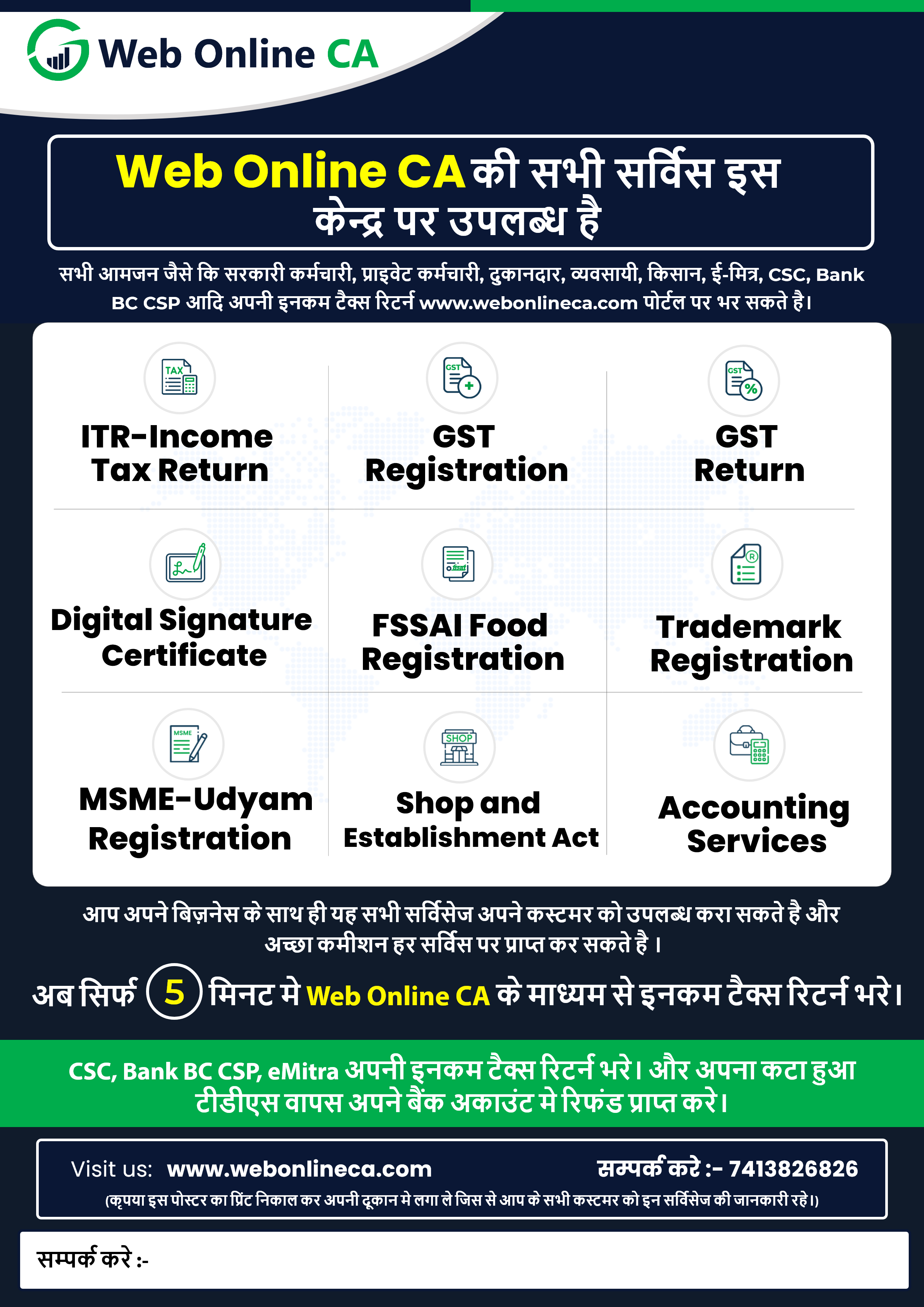

Web Online CA Assistance:

Web Online CA offers comprehensive services to assist you in the e-verification of your income tax return. Their experienced professionals can guide you through the process, ensuring accuracy and compliance. With their expertise, you can confidently complete the e-verification and avoid any potential issues.

Conclusion:

E-verifying your income tax return is a crucial step to complete the tax filing process. It ensures the authenticity and acceptance of your tax return by the income tax department. By following this step-by-step guide and availing the services of Web Online CA, you can easily navigate the e-verification process and stay compliant with tax regulations. E-verify your income tax return promptly to avoid any penalties and ensure a smooth tax filing experience.

E-verification of income tax returns is a crucial step in the filing process. It ensures that your tax return is authenticated and accepted by the income tax department. In this article, we will provide a comprehensive step-by-step guide to e-verify your income tax return. With the assistance of Web Online CA, you can easily complete the e-verification process and stay compliant with tax regulations.

Step 1: Choose the E-Verification Method

There are multiple methods available to e-verify your income tax return, including Aadhaar OTP, EVC (Electronic Verification Code) through net banking, and using a pre-validated bank account. Select the most convenient method for you.

Step 2: Login to the Income Tax e-Filing Portal

Visit the official income tax efiling and log in using your credentials. If you are a first-time user, register yourself and create an account.

Step 3: Access the E-Verification Options

After logging in, go to the "My Account" section and click on "E-Verify Return." You will find a list of available e-verification options.

Step 4: Choose the Desired E-Verification Method

Select the preferred e-verification method from the available options. Follow the instructions provided for each method to proceed with the verification.

Step 5: Generate and Enter OTP/EVC

Depending on the chosen method, you may need to generate an OTP or EVC. If using Aadhaar OTP, ensure that your Aadhaar is linked to your PAN. If using EVC, it will be sent to your registered mobile number or email address. Enter the OTP or EVC in the designated field.

Step 6: Complete the E-Verification Process

Once the OTP or EVC is entered, submit the verification request. The system will validate the details and authenticate your income tax return.

Step 7: Confirmation of E-Verification

After successful e-verification, you will receive a confirmation message. It is advisable to download and keep a copy of the confirmation for future reference.

Web Online CA Assistance:

Web Online CA offers comprehensive services to assist you in the e-verification of your income tax return. Their experienced professionals can guide you through the process, ensuring accuracy and compliance. With their expertise, you can confidently complete the e-verification and avoid any potential issues.

Conclusion:

E-verifying your income tax return is a crucial step to complete the tax filing process. It ensures the authenticity and acceptance of your tax return by the income tax department. By following this step-by-step guide and availing the services of Web Online CA, you can easily navigate the e-verification process and stay compliant with tax regulations. E-verify your income tax return promptly to avoid any penalties and ensure a smooth tax filing experience.

Location

Web Online CA, IInd Floor, Web Plaza, Nadi ka Phatak Benar Rd, Shyam Nagar, Shankar Vihar Extension, Jhotwara, Jaipur, Rajasthan 302012, India

Date & Time

August 3, 2023, 11:33 AM - 11:33 AM